The owner of a motorcycle in Nevada must purchase and maintain liability to register it, and to drive it. The minimum liability limits are the same as they are for cars.

Motorcycle drivers are subject to different risks than car and truck drivers, and the insurance that makes sense for a motorcycle driver may be different than what a car driver would buy.

Underinsured / uninsured coverage are important because there are many uninsured vehicles on Nevada roads, and, they are often ones that cause accidents. If you are on a motorcycle and injured, your medical expenses could be substantial. The minimum coverage for UM / UIM, 15/30, will not go far for a motorcycle accident victim that is transported and hospitalized. So, purchasing higher limits, like $25,000 per person, $50,000 per event should be considered.

If an accident victim has health insurance, it will subrogate, meaning that they will pay the medical bills, but will require reimbursement when the victim receives a recovery. Payments made by your motorcycle insurance company under your medical payments policy, if you purchased it, will not be the subject of a subrogation claim.

Nevada Requirements for Motorcycle Insurance

Motorcycle owners are required to carry the following minimums for liability insurance:

- $15,000 in bodily injury coverage for one person involved in an accident.

- $30,000 in bodily injury coverage for two or more people involved in an accident.

- $10,000 in property damage coverage for each accident.

The operator of the motorcycle is to have the insurance card at all times when operating the motorcycle. The state of Nevada requires only liability insurance, but many motorcycle owners prefer to be on the safe side by also securing collision and comprehensive coverage for their bikes.

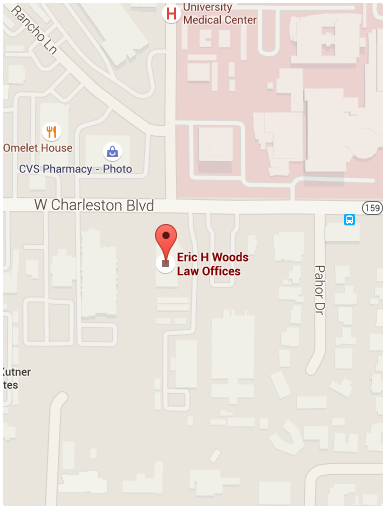

For more information about Nevada laws relating to motorcycle accidents or insurance and registration, contact attorney Eric Woods for a no-cost consultation.